How to Calculate Zakat in the USA: A Simple Guide for 2025

For many Muslims living in the U.S., calculating Zakat can feel overwhelming. With different types of wealth, changing nisab values, and differences in financial systems, it’s easy to second-guess how much you owe or when to pay it.

This guide is here to make the process simple, clear, and spiritually fulfilling.

What Is Zakat and Who Needs to Pay It?

Zakat is a pillar of Islam. It’s a form of obligatory charity (2.5% of your qualifying wealth) that is given once a year. It’s not a donation. It’s a right that the poor and vulnerable have over our wealth.

You’re eligible to pay Zakat if:

- You’re an adult Muslim

- You’ve had wealth above the nisab threshold for one full lunar year

How Much Zakat Do I Owe in 2025?

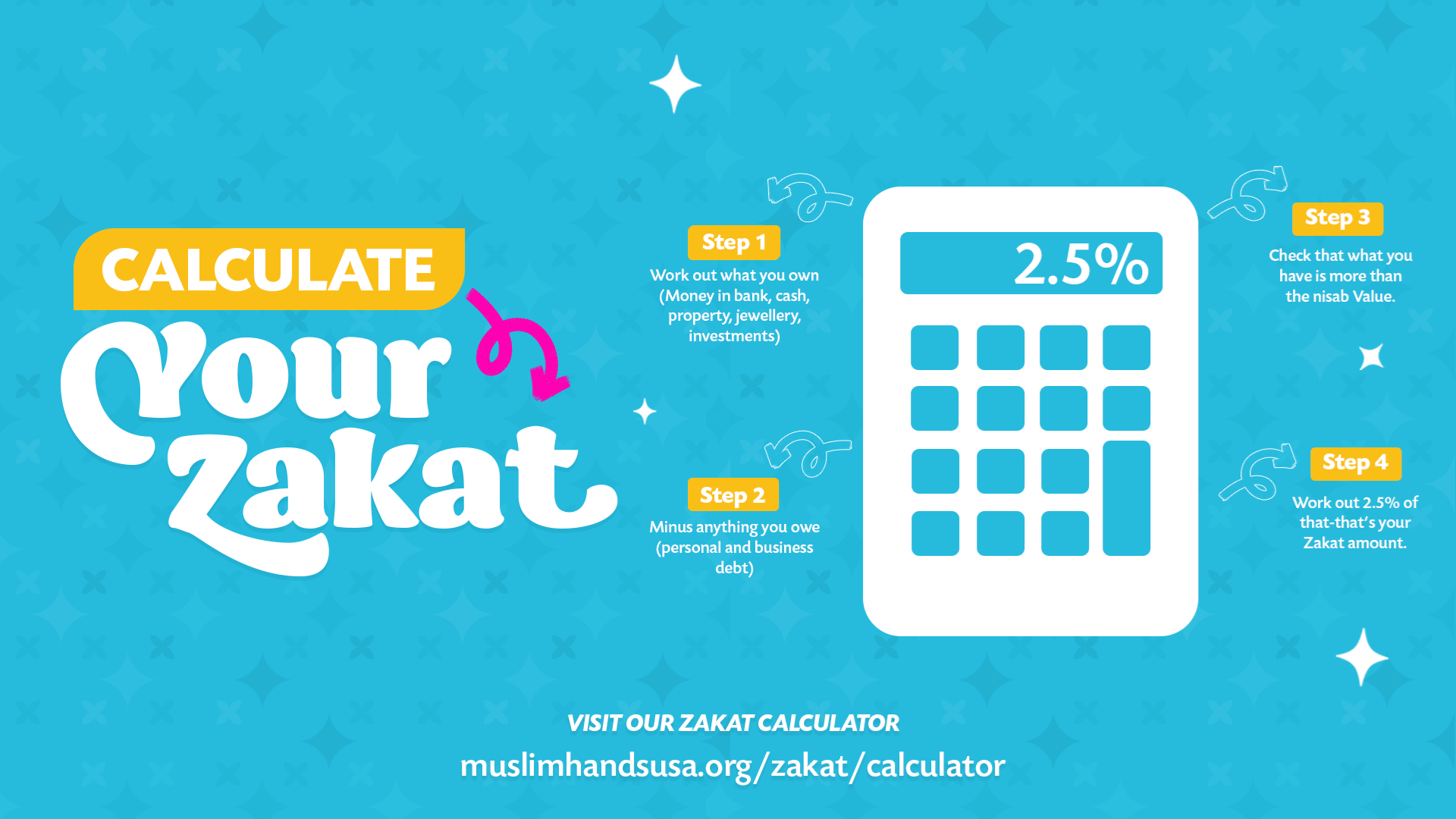

To calculate your Zakat, you need to know:

- Your total qualifying assets (cash, savings, gold, investments, etc.)

- The nisab value (threshold)

As of early 2025, the nisab is approximately:

- 87.48 grams of gold or

- 612.36 grams of silver

You owe 2.5% of your net qualifying wealth above the nisab amount. Our Zakat Calculator does the math for you accurately and instantly.

What Assets Should I Include When Calculating Zakat?

Your Zakatable assets include:

- Cash (on hand, in bank accounts)

- Savings and retirement funds (excluding penalties/taxes)

- Business inventory or profits

- Stocks and investments

- Gold and silver (based on current value per gram)

You can exclude:

- Primary home

- Personal use items (e.g., car, clothes)

- Immediate debts due

Why Use a USA-Based Zakat Calculator?

Most Zakat calculators are designed for global use but may not reflect USD-based assets, local cost of living, or tax-sensitive giving. Our Zakat Calculator for US donors is built specifically for your context.

It helps you:

- Calculate based on U.S. currency

- Track annual Zakat easily

- Understand what counts and what doesn’t

What Makes the Muslim Hands Zakat Calculator Unique?

- ✅ Easy to use, mobile-friendly

- ✅ Designed with scholars and community advisors

- ✅ Includes tips on assets, nisab, and timing

- ✅ Links directly to our Zakat-eligible programs: orphans, Gaza relief, water projects

You can go from confusion to clarity in just a few clicks.

How Do I Know the Calculator Is Accurate?

Our calculator is reviewed by qualified Islamic advisors and built for the real-life financial situations of U.S. Muslims. We also include current nisab values and account for variations in gold and silver prices.

When in doubt, we offer live support through our donor services team to guide you with sincerity and care.

What Happens After I Calculate My Zakat?

Once you know your Zakat amount, you can choose where to give and see the real impact of your charity.

At Muslim Hands USA, we direct Zakat toward:

- Feeding families during Ramadan and beyond

- Supporting orphans with food, education, and health care

- Emergency relief in Gaza, Yemen, and other crisis zones

- Water projects in underserved communities

👉 Learn more about our Zakat Fund

Real Impact, Real People

When you give Zakat through Muslim Hands USA, it doesn’t disappear into a system. It becomes something real; a warm meal delivered to a family in Gaza, a clean water source in Mali, or an orphan supported in Pakistan.

That’s what makes your Zakat powerful. It’s precise. It’s personal. And it’s deeply impactful.

Can I Give My Zakat Over Time?

Yes! Especially if you’ve calculated a large amount and want to divide it monthly. Just make sure the full amount is paid within your Zakat year.

You can also set up a monthly donation to make giving consistent and manageable.

Final Thoughts: Making Zakat Simple and Rewarding

Zakat is not just a financial obligation. It’s an act of faith, mercy, and solidarity.

By using a reliable Zakat calculator, you’re not only fulfilling a pillar of Islam you’re making sure your giving reaches those who need it most, with accuracy and trust.

👉 Use Our Zakat Calculator Now

Frequently Asked Questions About Zakat

Do I have to pay Zakat every year?

Yes. Zakat is due once every lunar year if your qualifying wealth remains above the nisab threshold. It’s a consistent obligation that helps support those in need on an ongoing basis.

Can I give Zakat to family members?

You can give Zakat to extended family members who qualify such as cousins, in-laws, or distant relatives but not to immediate dependents like your parents, children, or spouse.

What is the nisab threshold in dollars?

Nisab is based on the value of 87.48 grams of gold or 612.36 grams of silver. The dollar amount changes based on current market prices and is updated regularly on ours Zakat Calculator page.

Can I automate my Zakat payments?

Yes. Many donors choose to break their annual Zakat into monthly donations. This helps you stay consistent and still meet your full Zakat obligation by year’s end.

🔗 Set up a monthly Zakat donation here.